Welcome

to Johnbirchall-economist.com!

(The single

currency (Euro))

The

history of the Single Currency

EMU

STORY

The idea of an economic and monetary

union in Europe started well before the Treaties establishing the European

Communities after the Second World War (for example, already in the League

of Nations, Gustav Stresemann asked in 1929 for a European currency

against the background of an increased economic division due to a number

of new nation states in Europe after the Treaty of Versailles. (Historical

documentation of EMU)

How

the Euro evolved

Part 1: 1960 - 1969

The run-up to the Barre Plan

Part 2: 1969 - 1971

The first plans by stages to create an economic and monetary union

Part 3: 1971 - 1975

From the floating US-Dollar to the European Monetary System

Part 4: 1975 - 1980

The need to coordinate economic policies

Part 5: 1980 - 1988

The ECU in the centre of discussion

Part 6: 1988 - 1991

The run-up to the Maastricht Treaty

Part 7: 1992 - 1993

Work within the first phase of EMU

Part 8: 1994 - 1998

Work within the second phase of EMU

Part 9: 1999 - 2000

The start of the euro area ("EUR11")

Part 10: 2001 - 2002

The realisation of the third phase and enlargement of the euro area

("EUR12")

Other

Resources

http://ec.europa.eu/economy_finance/emu_history/documents/Presentations/

A%20single%20currency%20for%20Europe.ppt#1

An excellent power point presentation on

the reasons for the Euro and its role in EU expansion

http://ec.europa.eu/economy_finance/emu_history/documents/Presentations/

The%20Euro%20and%20international%20aspects.ppt#13

An excellent power point presentation on

the Euro and its international implications

http://www.ecb.eu/home/html/index.en.html

- The European Central Bank

Introducing

the Euro

Economic and monetary union (EMU)

comprises various stages.

The main objective of Stage

One, which began in 1990, was the complete liberalisation of capital

movements under Article 56 of the EC Treaty.

In Stage

Two, which began on 1 January 1994, the Member States implemented

measures enabling them to achieve the convergence targets necessary in

order to enter Stage Three of EMU and guaranteed the independence of their

central banks. The process of coordinating economic policies and ensuring

multilateral surveillance of progress with convergence began in the course

of Stage Two. The Member States were called on to do all they could to

avoid excessive public deficits.

In Stage Two the Member States had to

take measures to free their central banks of political interference.

Central banks are now responsible for monetary policy and, as such,

determine interest rates in the euro zone. They were also prohibited from

financing a budget deficit affecting the European institutions, the

governments of the Member States or other authorities, be they regional or

local, and from granting loans to state-owned companies.

Stage

Three of EMU began on 1 January 1999 with the launch of the euro on

financial markets. Under the accession treaty, the new Member States went

straight into Stage Three of EMU on 1 May 2004.

What

you must show before entering the Euro Zone

-

Price

stability, measured according to the rate of inflation in the

three best performing Member States;

-

Long-term

interest rates close to the rates in the countries with the best

inflation results;

-

An

annual budget deficit which does not exceed 3% of gross domestic

product (GDP) and total

government debt which does not exceed 60% of GDP or which is

falling steadily towards that figure;

-

Stability

in the exchange rate of the national currency on exchange markets

The exchange-rate mechanism of the European Monetary System requires

this stability to be demonstrated and sustained for two years.

Some

of the important data to consider when analysing the Euro and those who

wish to join

New Member

States Budget Deficits

|

New members

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Cyprus

|

-2.4

|

-2.4

|

-4.6

|

-6.3

|

-4.6

|

-4.1

|

|

Estonia

|

-0.3

|

0.3

|

1.8

|

2.6

|

0.7

|

0.0

|

|

Hungary

|

-3.0

|

-4.4

|

-9.3

|

-5.9

|

-4.9

|

-4.3

|

|

Latvia

|

-2.7

|

-1.6

|

-2.7

|

-1.8

|

-2.2

|

-2.0

|

|

Lithuania

|

-2.6

|

-2.1

|

-1.4

|

-1.7

|

-2.8

|

-2.6

|

|

Malta

|

-6.5

|

-6.4

|

-5.7

|

-9.7

|

-5.9

|

-4.5

|

|

Poland

|

-1.8

|

-3.5

|

-3.6

|

-4.1

|

-6.0

|

-4.5

|

|

Czech Republic

|

-4.5

|

-6.4

|

-6.4

|

-12.9

|

-5.9

|

-5.1

|

|

Slovakia

|

-12.3

|

-6.0

|

-5.7

|

-3.6

|

-4.1

|

-3.9

|

|

Slovenia

|

-3.0

|

-2.7

|

-1.9

|

-1.8

|

-1.7

|

-1.8

|

|

New members

|

-3.2

|

-4.1

|

-4.9

|

-5.7

|

-5.0

|

-4.2

|

|

EU15

|

1.0*

|

-1.0

|

-2.0

|

-2.6

|

-2.6

|

-2.4

|

|

EU25

|

0.9*

|

-1.1

|

-2.1

|

-2.7

|

-2.7

|

-2.5

|

|

Euro zone

|

0.1*

|

-1.6

|

-2.3

|

-2.7

|

-2.7

|

-2.6

|

Applicant

States Budget Deficits

|

Applicant countries

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Bulgaria

|

-0.5

|

0.2

|

-0.8

|

-0.1

|

-0.7

|

-1.0

|

|

Romania

|

-4.4

|

-3.5

|

-2.0

|

-2.0

|

-3.0

|

-3.0

|

|

Turkey

|

-6.1

|

-29.8

|

-12.6

|

-8.8

|

-7.1

|

-6.0

|

Member States

Government Deficits

|

New members

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Cyprus

|

61.7

|

64.4

|

67.1

|

72.2

|

74.6

|

76.9

|

|

Estonia

|

5.0

|

4.7

|

5.7

|

5.8

|

5.4

|

5.3

|

|

Hungary

|

55.4

|

53.5

|

57.1

|

59.0

|

58.7

|

58.0

|

|

Latvia

|

13.9

|

16.2

|

15.5

|

15.6

|

16.0

|

16.1

|

|

Lithuania

|

24.3

|

23.4

|

22.8

|

21.9

|

22.8

|

23.2

|

|

Malta

|

57.1

|

61.8

|

61.7

|

72.0

|

73.9

|

75.9

|

|

Poland

|

36.6

|

36.7

|

41.2

|

45.4

|

49.1

|

50.3

|

|

Czech Republic

|

18.2

|

25.2

|

28.9

|

37.6

|

40.6

|

42.4

|

|

Slovakia

|

49.9

|

48.7

|

43.3

|

42.8

|

45.1

|

46.1

|

|

Slovenia

|

26.7

|

26.9

|

27.8

|

27.1

|

28.3

|

28.2

|

|

New members

|

36.4

|

38.5

|

39.4

|

42.2

|

44.4

|

45.2

|

|

EU15

|

64.0

|

63.2

|

62.5

|

64.0

|

64.2

|

64.2

|

|

EU25

|

62.9

|

62.1

|

61.5

|

63.1

|

63.4

|

63.4

|

|

Euro zone

|

70.4

|

69.4

|

69.2

|

70.4

|

70.9

|

70.9

|

Applicants

States – Government Deficits

|

Applicant countries

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Bulgaria

|

73.6

|

66.2

|

53.2

|

46.2

|

44.4

|

43.2

|

|

Romania

|

23.9

|

23.2

|

23.3

|

21.8

|

23.5

|

23.5

|

|

Turkey

|

57.4

|

105.2

|

94.3

|

87.4

|

83.4

|

77.5

|

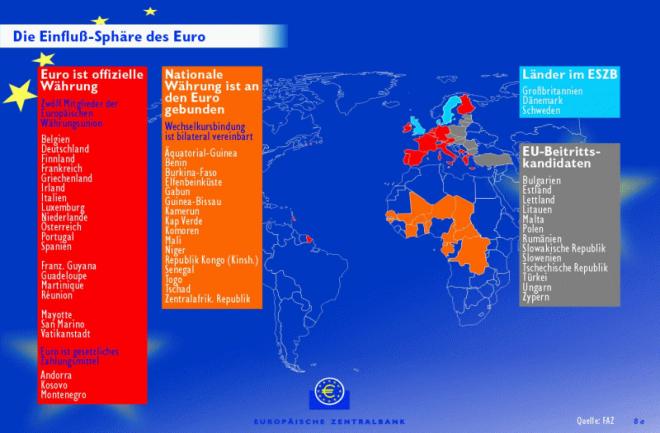

Where the Euro

can be used